July annuity update

July Annuity Update

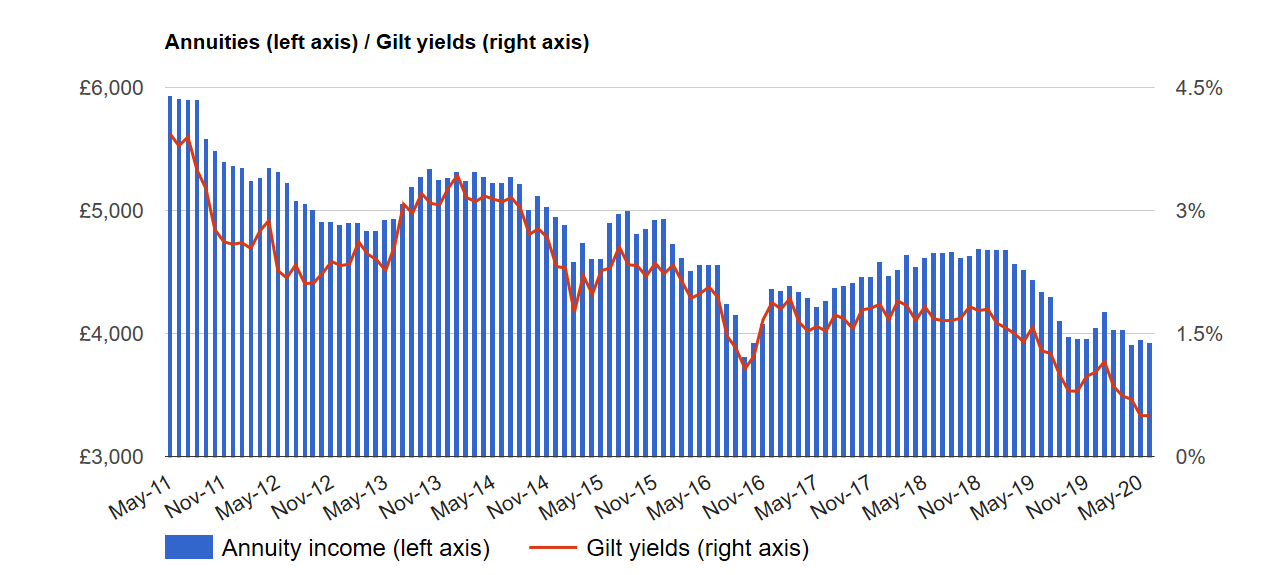

Annuities are still in the doldrums and there is no sign that rates will increase in the short term.

As long as interest rates remain low and inflation benign, annuities well remain at the current levels.

Key indicators

| Jul 2020 | Jun 2020 | Jul 2019 | |||

| This month | Last month | change | 12 months | change | |

| Benchmark annuity1 | £3,843 | £3,930 | -2.22% | £4,302 | -10.68% |

| Gilt yield2 | 0.54% | 0.50% | 1.26% | ||

| FTSE 100 | £6,157 | £6,166 | -0.15% | £7,497 | -17.87% |

Bond yields

Annuity rates are priced with reference to the yields on long term fixed interest investments such as gilts and corporate bonds.

The benchmark gilt yield (15-year gilt as quoted in the FT) has fallen through the floor. At the beginning of 2020 the benchmark gilt yield was just over 1% but recently it fell to 0.4%, before bouncing back to 0.54% at the beginning of July. These are still close to the lowest level since I started recording yields 20 years ago.

Gilt yields have fallen as direct result of the flight to quality as investors sell equities and buy secure gilts. As more people buy gilts the price rises but the yield falls.

Falling annuity rates

In practical terms, a £100,000 joint life annuity for a couple aged 65 and 60 paid £4,188 per annum gross in January but today the same annuity will only pay £ 3,842 per annum. This is a £ 346 per annum drop in income which is a fall of over 8%.

Market recovery

It is not all bad news for those thinking about purchasing an annuity because financial markets have made a limited recovery.

This means that those invested in equity funds will now have more money in their pension pots to buy an annuity so the result is a higher income.

However, the current crisis is far from over and everybody approaching retirement age should consider switching into low were risk funds